32+ payroll tax calculator maryland

Process Payroll Faster Easier With ADP Payroll. Web How does Maryland collect unemployment tax.

Sec Filing Nkarta Inc

Get Started With ADP Payroll.

. Web If you have any questions please contact our Collection Section at 410-260-7966. Approve Payroll When Youre Ready Access Employee Services Manage It All In One Place. On top of the state income taxes Maryland counties and the city of Baltimore charge each their own.

For 2023 Marylands Unemployment Insurance Rates range from 1 to 105 and the wage base is 8500 per year. If you make 70000 a year living in Maryland you will be taxed 11177. Compare Side-by-Side And Find The Best Payroll For Your Business.

The new W4 asks for a dollar amount. Web The above rates apply to Maryland taxable incomeMaryland taxable income is based on your federal adjusted gross income AGI but with some differences. Ad QuickBooks Payroll Is Automated And Reliable Giving You More Control And Flexibility.

Web Our free payroll tax calculator can help you answer questions about federal and state withholding. Ad One intuitive service to manage HR payroll benefits. Ad Boost Your Business Productivity With The Latest Simple Smart Payroll Systems.

2023 ERC Program Eligibiliity Verification - Get Up to 26k Per Eligible Employee. Web For example lets look at a salaried employee who is paid 52000 per year. All Services Backed by Tax Guarantee.

Web Maryland has a progressive state income tax system with eight tax brackets. Free Unbiased Reviews Top Picks. Enter an amount for dependentsThe old W4 used to ask for the number of dependents.

One simple place to keep your team happy and productive. Ad Payroll So Easy You Can Set It Up Run It Yourself. Ad Calculate Your Payroll With ADP Payroll.

Dont forget about federal payroll taxes. Find The Best Payroll Software To More Effectively Manage Process Employee Payments. Ad So Many Options To Easily Run Your Payroll-Compare All terms and prices Top Brands Only.

Web Maryland State Unemployment Tax. 52000 52 payrolls 1000. Some are paid by the employer some are paid by the employee and some are jointly paid.

Quarterly Estimated Tax Calculator - Tax Year 2022. Approve Payroll When Youre Ready Access Employee Services Manage It All In One Place. Get Started For Free.

Heres how to calculate it. Ad Compare This Years Top 5 Free Payroll Software. This net pay calculator can be used for estimating taxes and net pay.

Marylands unemployment tax is charged on the first 8500 of each employees salary each year. Ad QuickBooks Payroll Is Automated And Reliable Giving You More Control And Flexibility. Your average tax rate is 1167 and your marginal.

If this employees pay frequency is weekly the calculation is. Ad Get a Payroll Tax Refund Receive Up To 26k Per Employee Even if you Received PPP Funds. Web Federal payroll taxes in Maryland.

Web Maryland Payroll Taxes. Fingerchecks payroll solution offers more in-depth information about such. Get 3 Months Free Payroll.

New employers will pay a 23. Web Maryland Income Tax Calculator 2022-2023. Web This version of Net Pay Calculator should be used by those who submitted Federal W-4 in 2020 or later.

Statewide rate between 2-575 depending on income plus a flat county or city tax rate of 225-32 depending.

Free 7 Sample Payroll Tax Calculator Templates In Pdf Excel

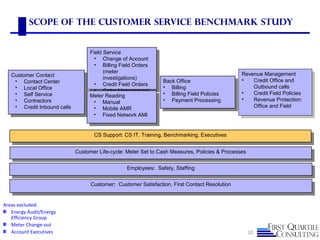

2014 Cs Data Collection Guide 1

Free 7 Sample Payroll Tax Calculator Templates In Pdf Excel

If The Ctc Is 32 Lpa What Is The In Hand Salary In India In 2022 Quora

What Is It Like To Be Saving 70 Of Your Salary Quora

Nktx 10k 20201231 Htm

Bnb Grant Round 1 Grants Dorahacks

New General Mathematics 3 Pdf Equations Trigonometric Functions

0kw59xe6n5nm8m

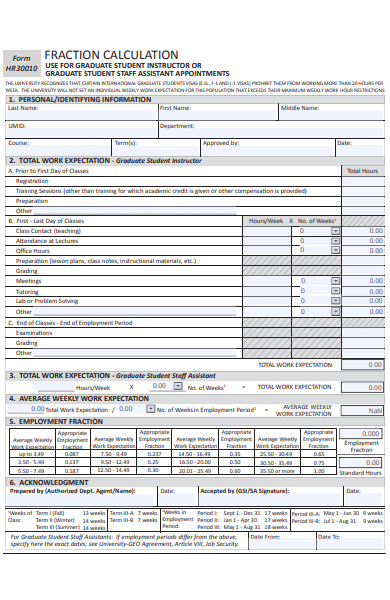

Free 31 Calculation Forms In Pdf Ms Word

Tax Pro Details

1902 Horns Point Road Cambridge Md 21613 Compass

Vb Net How To Find Federal Taxes Based On Salary Ranges Stack Overflow

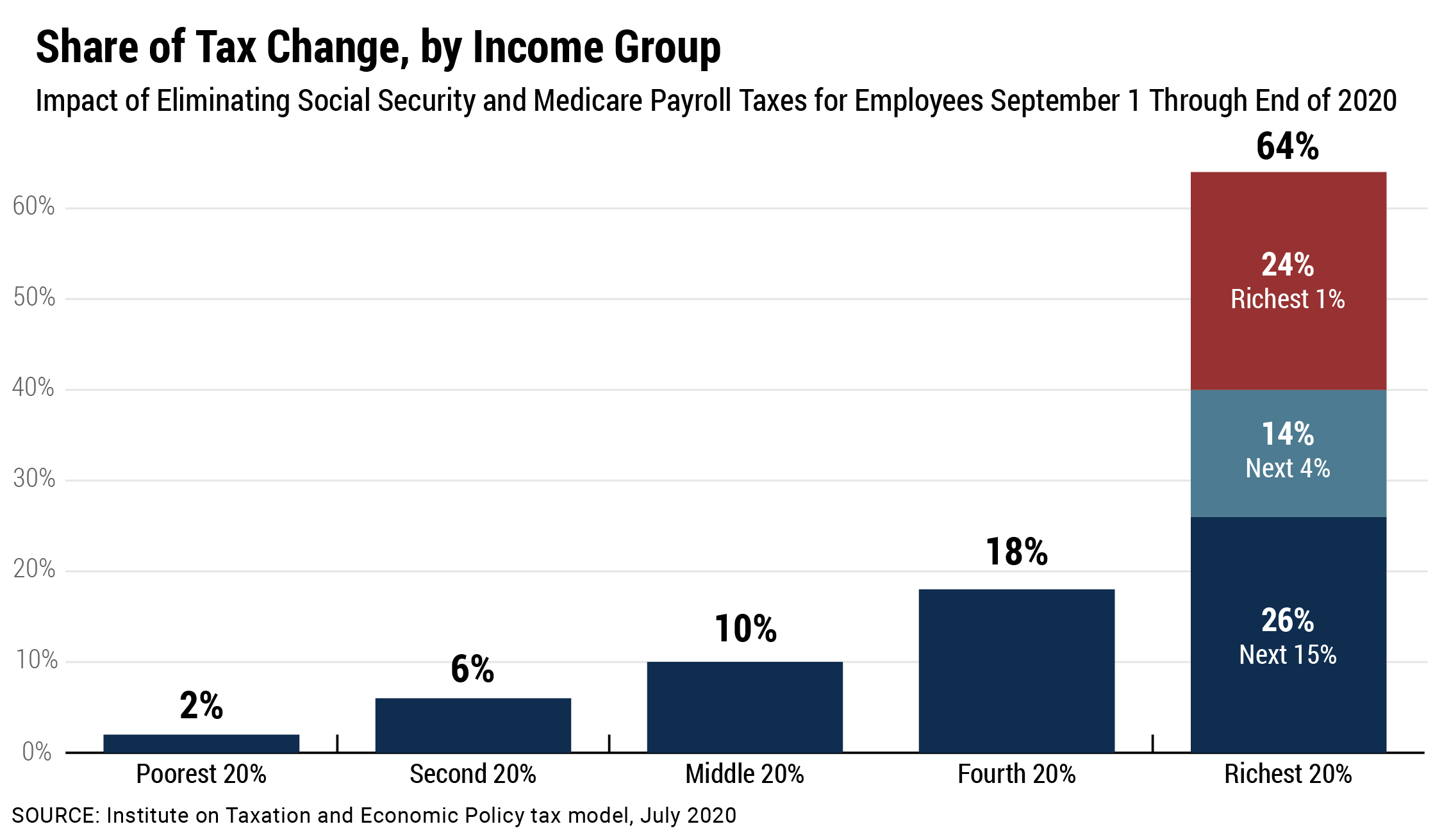

An Updated Analysis Of A Potential Payroll Tax Holiday Itep

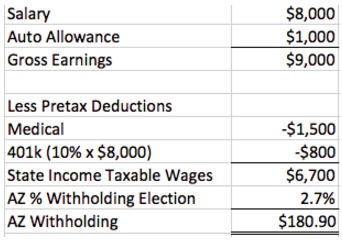

How Are Payroll Taxes Calculated State Income Taxes Workest

Environmental Valuation Cost Benefit News February 2020

An Updated Analysis Of A Potential Payroll Tax Holiday Itep